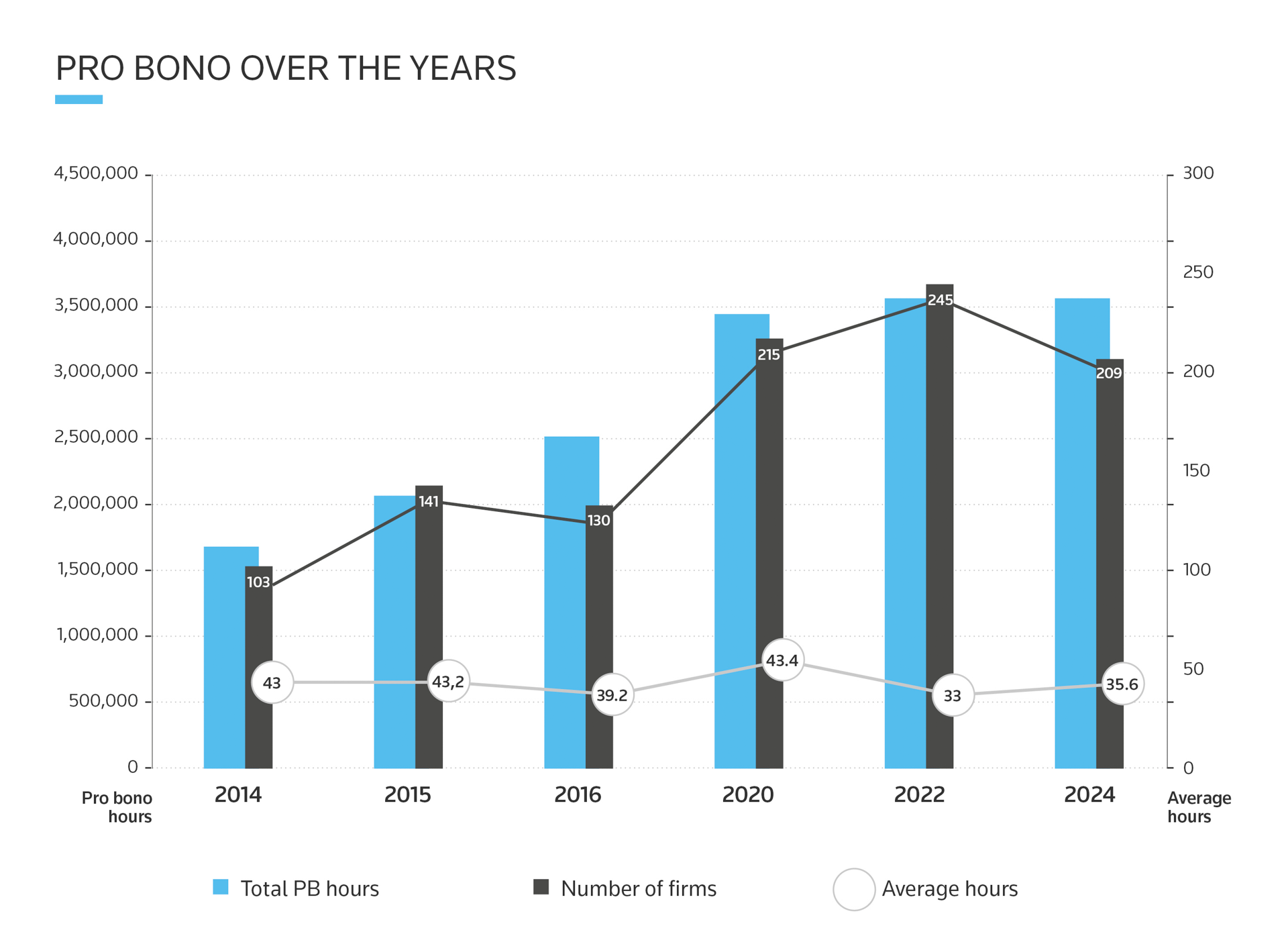

When the first edition of the TrustLaw Index of Pro Bono launched in 2014, it was an ambitious idea. We aimed to map pro bono around the world and harness the power of data to track trends, surface good practice and offer benchmarks for pro bono.We first published the Index on an annual basis, (2014, 2015 and 2016), followed by a brief hiatus before returning as a biennial survey (2020, 2022 and 2024).

In 2014, 103 firms covering 36,000 lawyers with offices across 69 countries participated in the survey. Since then, the number of firms participating has more than doubled to 209 and number of lawyers has nearly tripled to 100,000 across 123 countries and jurisdictions. Much of this growth is due to the expanding reach of the survey to new markets outside of the largest pro bono markets in the US, UK (England & Wales) and Australia.The biggest gains have been in Asia and the Pacific (where participation more than doubled) and in the Americas (nearly tripled).

Are we hitting a plateau?

This year lawyers provided an average of 35.6 hours of pro bono over the year. Globally, 57 percent of lawyers engaged in pro bono and 43 percent of lawyers dedicated ten or more hours of their time to pro bono work in the year.

However, following a banner year in 2020 and despite a recovery in average hours from 2022, we have not returned the high-water mark we saw in 2020 (43.4 hours on average per lawyer). Similarly, the percentage of lawyers doing any or more than 10 hours of pro bono has largely held steady at 43 percent and not returned to the figures reported in 2020 (46 percent). Among partners, we see a similar trend, with average partner hours since we began reporting this metric in 2020 remaining largely constant, with a slight dip this year.

What is behind this trend? On one hand, over time we have seen relatively consistent average pro bono hours even as the survey participation has expanded —which is positive. Since 2014, the number of participating firms has doubled and lawyers represented has tripled, with particularly strong growth in Asia-Pacific and the Americas. While newer entrants typically start with more modest engagement levels, to some extent this has the effect of balancing against growth in engagement and hours in more established practices.

However, we also know pro bono is influenced by broader market forces. Many firms are navigating growing competitive pressures from cost-conscious clients, new market entrants, and emerging technologies. If pro bono is viewed only as a “nice to have”, it can be seen as less of a priority alongside billable pressures—though, our view is that this is shortsighted given the rising business benefits of pro bono.

Meanwhile, the need for pro bono continues to grow, driven by threats to civic space, human rights, the climate crisis and a persistent justice gap. Legal tech, AI and innovation offer promising opportunities to expand access to justice and create more efficient pro bono delivery models, but the unmet need is expansive, and unlikely to be addressed only through such efficiencies. As we look ahead to the next ten years, it will be crucial for the legal sector to galvanise and for lawyers to commit their valuable time as well if we are to rise to the need.

Rise of the business case for pro bono

Since 2015, we have asked firms why they do pro bono. The most common answer has remained remarkably consistent over the years—that is, a desire to support the community. It indicates that a deep, abiding sense of community and service is at the heart of why many lawyers and firms do pro bono.

However, we have also seen rising attention to other motivations, especially in relation to staff (training and skills development and retention) and clients (marketing and alignment with client interest). This is not surprising given the trend in recent years that has seen the legal sector becoming more competitive and business minded.

The importance of training and skill development has increased over time, from 45 percent in 2015 to 73 percent in 2024, suggesting that pro bono is increasingly seen as a valuable opportunity for professional growth and skill enhancement. We have also seen emphasis on staff retention more than double from 23 percent in 2015 to 47 percent in 2024. This trend indicates that firms may be leveraging pro bono opportunities to engage and retain employees, recognising the role of meaningful work in job satisfaction and retention.

The importance placed on marketing has more than doubled, from 22 percent in 2015 to 45 percent in 2024, suggesting firms are increasingly viewing pro bono work as a strategic tool to enhance their brand and public image. In a broader trend, alignment with client interest as a reason for doing pro bono has grown from 25 percent in 2015 to 34 percent in 2024, though the trend line has varied somewhat over the years.

We expect this area to continue to grow as we see in-house teams pushing the pro bono agenda by incorporating pro bono into tenders for legal work and seeking more opportunities to partner with their panel firms directly on pro bono projects.

What works for growing pro bono

Over the years, we have seen a modest but meaningful growth in formalisation of pro bono within firms.

The percentage of firms that report at least one or more element of pro bono infrastructure has increased from 78 percent in 2014 to 88 percent in 2024, and across all categories of infrastructure that we measure such as:

- Pro bono policies: percentage of firms with pro bono policies rose from 64 percent in 2015 to 71 percent in 2024.

- Pro bono committees: percentage of firms with pro bono committees rose from 52 percent in 2014 to 57 percent in 2024.

- Pro bono coordinators: percentage of firms with pro bono coordinators rose from 78 percent in 2014 to 83 percent in 2024.

Over the years we see a trend in which law firms with pro bono infrastructure report higher average hours per fee earner compared to those without such infrastructure. This suggests that having such infrastructure helps to encourage more pro bono work.This is especially true for Medium-sized and Large Firms who benefit most.

Perhaps even more influential is the key role of incentives in encouraging individual lawyers to do pro bono.

Over the years, there has been a significant increase in the percentage of law firms with pro bono targets, rising from 21 percent of firms in 2014 to 42 percent, in 2024. This indicates a growing recognition of the value of setting pro bono goals to encourage participation. Over time, law firms with pro bono targets tend to report higher average pro bono hours compared to those without targets. Firms with mandatory targets are consistently associated with higher average hours than aspirational targets (typically by a difference of 30 percent or more).

Interestingly, as more firms have adopted targets, the trend has been to set aspirational rather than mandatory targets, even though mandatory targets are associated with higher hours. Since 2014, the overall number of firms adopting targets has doubled but the balance has shifted from 55 percent mandatory to 45 percent aspirational in 2014, to 24 percent mandatory to 76 percent aspirational in 2024.

Treating pro bono work the same as billable work for hours target purposes is a proven motivator for pro bono —in 2024, we see that firms that do so do twice the pro bono of those who do not–16 versus 31.5 average hours- and this finding is consistent over the years. Overall, the number of firms adopting this practice has risen slightly from 63 percent in 2014, to 68 percent in 2024. Most firms continue to implement such programmes by treating all pro bono hours in the same way as fee-earning work, and the percentage of firms doing so has slowly increased from 43 percent in 2015 to 52 percent in 2024.

The practice of factoring pro bono in annual review and/or compensation decisions is becoming more common, and these incentives are consistently associated with higher hours.

- The proportion of firms reporting that pro bono factored in their appraisal/performance review process for lawyers rose from 66 percent in 2014 to 80 percent in 2024. Meanwhile, we see a consistently positive relationship with hours (around double)- in 2024, the difference is 40.7 hours at firms that do this, versus 19 hours at firms that do not factor it.

- Similarly, the proportion of firms that factored pro bono in compensation decisions rose from 49 percent in 2014 to 57 percent in 2024. Here too, we see a consistent positive relationship to hours: For example, in 2024 the differential was 17.4 versus 29.7 hours.

At the heart of pro bono—access to justice

Each year, we ask what firms are prioritising as their areas of focus for pro bono. We have seen consistent focus on access to justice over the last decade, a finding that transcends firm size and geography and can be understood in the context of a persistent justice gap facing much of the world, with an estimated two-thirds of people still experiencing unmet justice needs.

Over this time, we have also seen:

- A meaningful increase in focus on immigration, refugees and asylum, with a significant jump in focus in 2016 and a consistent rise since 2016—from 28 percent in 2014 to 44 percent in 2024.

- A gradual but steady rise in attention to LGBTQ+ rights —from 9 percent in 2014 to 27 percent in 2024.

- An overall upward trend—with some ups and downs—of focus on environment, climate and biodiversity, from 25 percent in 2014 to 30 percent in 2024, though perhaps not as significant an increase as we might have expected given rising public awareness of the biodiversity and climate crisis.

- A reduced focus on economic development and microfinance (now at 19 percent, from 44 percent in 2014 and a high of 52 percent in 2016), and education, training and employment (23 percent, from 34 percent in 2014 and a high of 46 percent in 2016)which were among the most selected areas of focus of pro bono when the Index launched.

Over the years, we have seen no material change in the types of clients receiving pro bono. Charities, non-profits, social enterprises and individuals in need have continued to be the most common recipients of pro bono services. In 2024, we offered two new categories for small businesses/start-ups and journalists in need/small news organisations, both of which are receiving considerable attention (previously captured by the category “other”, which dropped significantly this year).

Across a decade of the Index, we see a nuanced portrait of the global pro bono ecosystem. The trend in average hours and engagement has been relatively steady but not marked by year-on-year growth. The sector has been evolving and formalising, with growing numbers of survey entrants from markets in Latin America, Africa and Asia—the growing global reach of pro bono is certainly to be celebrated. The rising importance of pro bono for client and employee recruitment and retention is notable, and one to watch in years to come.

Over time, we see a responsive pro bono sector—offering sustained commitment to a range of pro bono clients and causes, together with growing focus on areas like immigration, refugee and migration, LGBTQ+ rights and climate and environment as these concerns have risen on the global agenda. Law firms shifted their pro bono priorities to meet the needs of the most vulnerable communities over the decade, and we hope this need-driven approach to pro bono will continue.

We also see, time and again, that formalising pro bono is beneficial—whether through infrastructure or incentives or both—and there are proven approaches to galvanise growth in pro bono and meet the challenge of unmet legal needs around the globe in the decade ahead.